Fascination About Hsmb Advisory Llc

Table of ContentsEverything about Hsmb Advisory LlcHsmb Advisory Llc - TruthsHsmb Advisory Llc Can Be Fun For EveryoneThe 8-Minute Rule for Hsmb Advisory LlcHsmb Advisory Llc - An OverviewThe Best Strategy To Use For Hsmb Advisory Llc

Ford claims to avoid "money worth or permanent" life insurance policy, which is even more of an investment than an insurance. "Those are very made complex, included high commissions, and 9 out of 10 people do not require them. They're oversold due to the fact that insurance policy agents make the biggest compensations on these," he claims.

Handicap insurance coverage can be pricey. And for those who decide for lasting care insurance policy, this plan may make impairment insurance coverage unneeded.

Fascination About Hsmb Advisory Llc

If you have a chronic health issue, this sort of insurance coverage can end up being vital (Insurance Advise). Nonetheless, don't allow it emphasize you or your savings account early in lifeit's usually best to secure a policy in your 50s or 60s with the expectancy that you won't be using it up until your 70s or later.

If you're a small-business owner, consider securing your income by acquiring business insurance coverage. In case of a disaster-related closure or period of rebuilding, company insurance can cover your earnings loss. Take into consideration if a significant weather event impacted your store or manufacturing facilityhow would certainly that impact your earnings? And for the length of time? According to a record by FEMA, in between 4060% of local business never ever resume their doors adhering to a calamity.

Plus, utilizing insurance coverage could occasionally cost more than it conserves in the lengthy run. If you get a chip in your windshield, you might think about covering the repair service expenditure with your emergency situation financial savings instead of your automobile insurance. Why? Since utilizing your automobile insurance policy can create your monthly premium to increase.

What Does Hsmb Advisory Llc Mean?

Share these suggestions to protect enjoyed ones from being both underinsured and overinsuredand seek advice from a trusted expert when needed. (https://hsmbadvisory.start.page)

Insurance that is acquired by an individual for single-person coverage or insurance coverage of a family members. The specific pays the premium, rather than employer-based health insurance coverage where the employer usually pays a share of the premium. Individuals might purchase and acquisition insurance coverage from any strategies available in the individual's geographic region.

People and family members may certify for financial help to reduce the expense of insurance coverage premiums and out-of-pocket costs, but just when signing up with Attach for Health And Wellness Colorado. If you experience particular adjustments in your life,, you are qualified for a 60-day period of time where you can sign up in an individual strategy, also if it is outside of the yearly open registration period of Nov.

15.

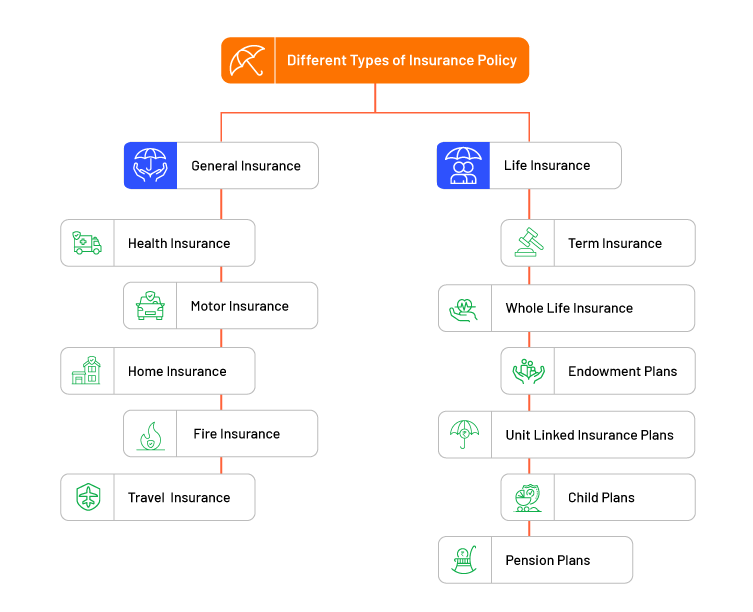

It may appear simple however understanding insurance coverage kinds can additionally be confusing. Much of this confusion originates from the insurance coverage industry's continuous goal to make personalized coverage for insurance policy holders. In making adaptable policies, there are a range to pick fromand all of those insurance policy types can make it challenging to recognize what a particular policy is and does.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

If you die throughout this period, the person or people you've called as beneficiaries may get the cash money payment of the policy.

Nevertheless, numerous term life insurance policy plans allow you transform them to an entire life insurance policy policy, so you do not shed coverage. Commonly, term life insurance coverage policy premium payments (what you pay per month or year into your plan) are not secured at the time of acquisition, so every five or 10 years you have the policy, your premiums could increase.

They likewise tend to be cheaper overall than whole life, unless you get an entire life insurance coverage plan when you're young. There are likewise a few variants on term life insurance policy. One, called group term life insurance policy, is typical among insurance choices you might have access to via your company.

The Hsmb Advisory Llc Ideas

One more variant that you may have accessibility to with your employer is supplemental life insurance., or interment insuranceadditional insurance coverage that could assist your household in situation something unexpected takes place to you.

Permanent life insurance just refers to any kind of life insurance coverage plan that does not run out.